While the mass rollout of Studio SVODs to every overseas destination that can be reached appears to be on pause, for some the effects of many studios going nearly all-in on vertical integration can still be felt. By excluding vertical integration from the distribution of scripted content, Show Tracker reveals the level of change between 2021 and 2022 in third party acquisitions of brand new scripted series around the world.

Markets that once held a healthy level of third party acquisitions are starting to see this status quo threatened - particularly Australia which saw the largest decline in third party premieres in 2022. One big factor is the expiry of volume deals such as the one Paramount had with local SVOD Stan, which the studio happily traded in order to vertically integrate their pipeline to support Paramount+ in Australia.

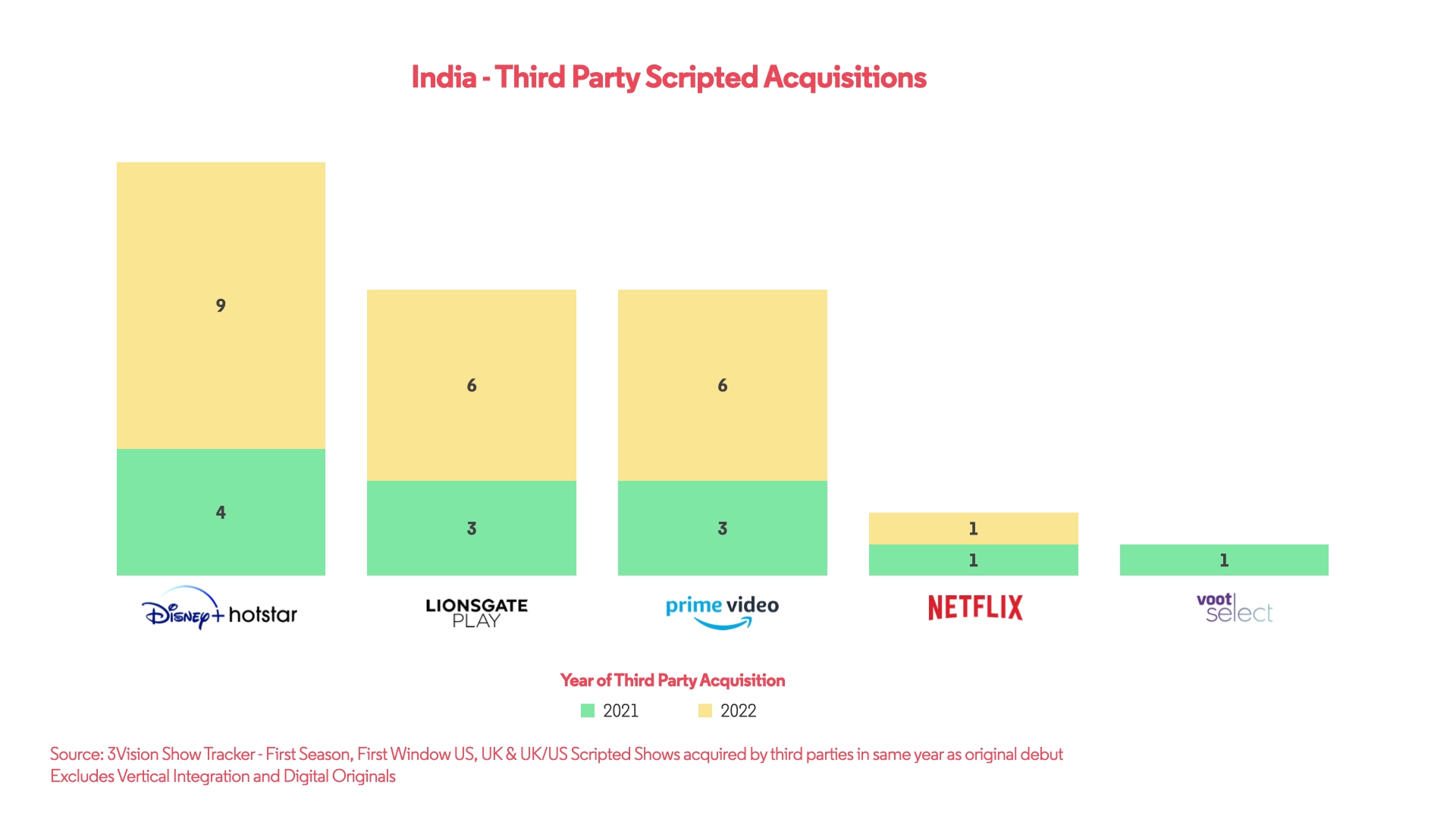

India and Japan are the markets that saw the most growth in third party acquisitions. In the case of India this does not mean a renewed appetite for new content from local buyers but instead activity largely led by the same studio SVODs acquiring from their own distribution arms, supplementing their service libraries with third party series.

Third party activity from Disney+ Hotstar continues to be largely restricted to HBO series, part of a volume deal inherited in Disney’s acquisition of Star India, while Lionsgate Play continues to acquire as many new series as Amazon Prime in the region. India has remained an important enough market for Lionsgate not to retract the service like it plans to in many other markets this year.

Japan’s growth in 2022 was fuelled largely by the local SVOD U-Next which has signed volume deals with both Paramount and Warner Bros. Discovery to support its ‘Only One’ strategy which aims to offer an abundance of exclusive content to their users in one place.

While the hard turn many studios took into vertical integration will have provided a particular challenge for local services looking to acquire content, third party distributors may still yet struggle to find appropriate local buyers for their series in certain markets. As many studios begin to re-evaluate their all-in approach to vertical integration, it is more important than ever for distributors and buyers to be able to keep an eye on the changes in the distribution landscape.

.svg)