Local players in international markets have long felt a squeeze on the supply of US content available to acquire for their services. Vertical integration and volume deals have dominated the most award-winning content, limiting the opportunities available for local players, while the strikes in Hollywood are set to reduce the number of titles available in the upcoming 2023/24 season. With this in mind, it becomes more important than ever for distributors to understand the largest players in the local SVOD space, as many services have built up their subscriber base by being a prolific home for acquired US content. Show Tracker reveals the top local SVOD buyers across international markets.

Leading the way is Multichoice’s SVOD Showmax, gaining much momentum thanks to its recent investment from NBCUniversal, bringing with both an injection of new Peacock technology to the SVOD but also a likely safe route for NBCUniversal content in the future. Behind Showmax sits Wavve, operating in Korea, and U-Next, operating in Japan. Both find themselves benefiting with content deals from Warner, with Wavve expanding its deal to include HBO Max series and U-Next’s Warner deals helping make it the biggest buyer in Japan.

Most of the biggest Local SVOD buyers find themselves interested in a healthy mix of both US and UK content, but certain local players find themselves favouring UK series. For some such as NPO Plus, this becomes more indicative of similar priorities they once reserved for their linear channels as a public broadcaster. Other SVOD services, such as FilmIn in Spain, acquire series exclusively from the UK to build a niche selling point to their platforms as a home of quality UK series.

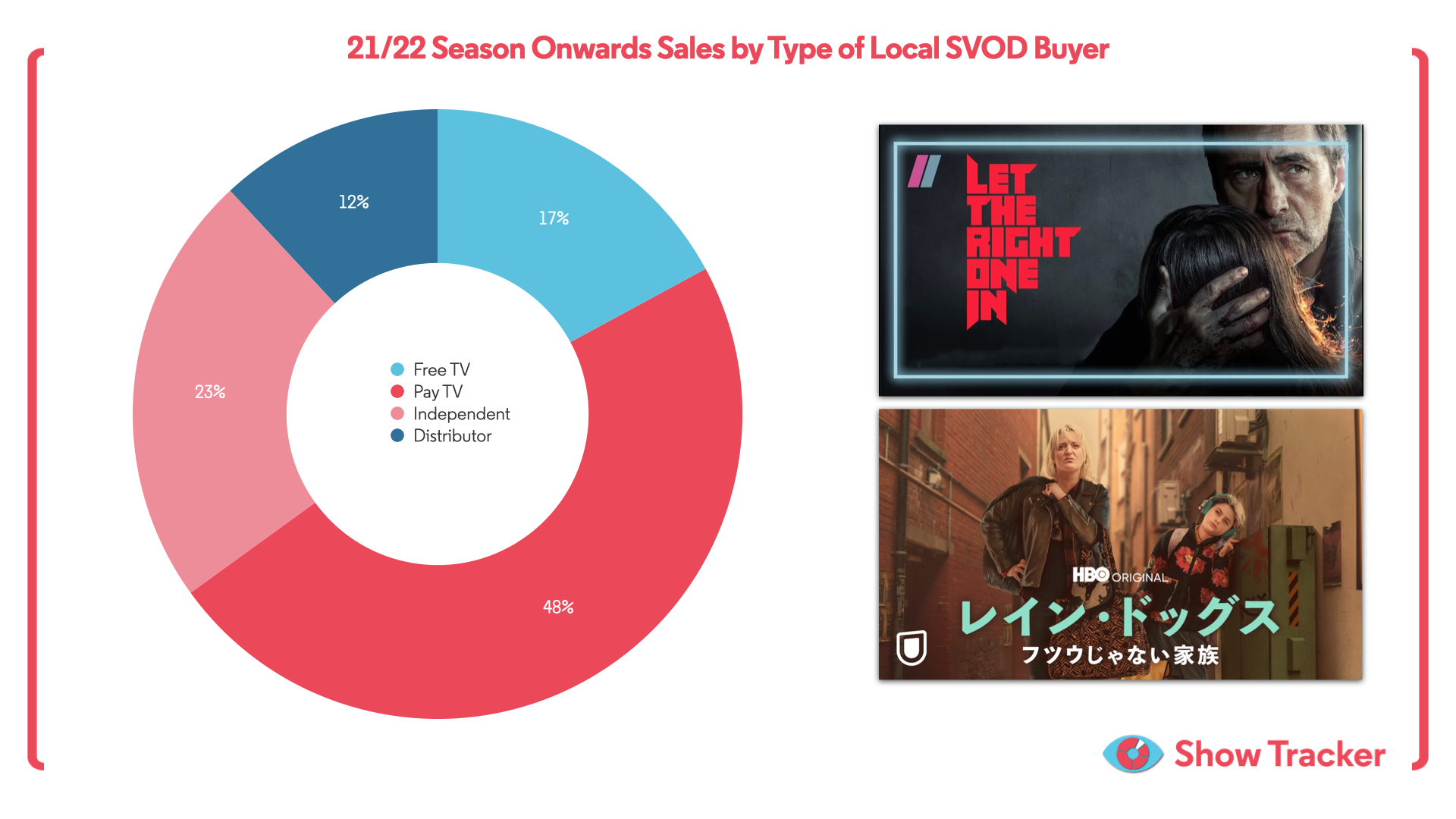

What is quickly apparent is how very few local SVOD services are what could be described as truly independent. Of the top 20 SVOD services, only four operate without a major industry owner. Some of Asia’s biggest buyers are independent SVODs, but outside of this region many services are owned by broadcasters in Free TV or Pay TV as well as some owned by distributors, opening up opportunities for vertical integration in ways not unlike Disney’s current all-in approach.

It is in fact Pay TV owned local SVODs that lead in premieres, with players like Showmax in South Africa or Bell Media’s Crave in Canada helping to account for nearly half of all acquisition activity in this space.

Independent local SVOD services account for less than a quarter of new acquisitions, leaving much of the activity in the hands of Pay TV service owners and operators. By diversifying their service portfolios, Pay TV companies can hopefully mitigate the loss of subscribers many have seen from their Pay TV subscriptions, while potentially gaining new users as they aim to become viable competitors to the likes of Netflix, Amazon and Studio SVODs within their local market.

As the content market is set to squeeze, with many SVODs partaking in volume deals likely to see less content than they would like arrive on their services in the fall, the appetite for third party content is likely to be higher than ever. Pay TV owned local SVODs will likely be the most hungry to engage with distributors for what little might be available.

Want to stay in the loop with everything happening with TV show distribution? Get regular insights from our analysts on the latest trends, delivered straight to your inbox by signing up to our Show Tracker Insights below.

.svg)