The 3Vision annual Trends Survey collates feedback from senior media executives

Download the 2020 Trends Survey Results

D2C activity dominated 2019 with a number of major content owners launching or revealing plans to enter the market. Respondents to our 2020 Trends Survey believe that for new SVOD services to succeed they need to exploit the synergies with Pay TV and find their place within new aggregator platforms.

Broadcasters are finding many different ways to respond to the new world they exist in and our respondents certainly feel more of this is to come, forming new alliances and ventures - not just in terms of new OTT platforms but in financing and co-producing bigger shows with international appeal.

With the 2020 Trends Survey results we look at the year ahead and see that as far as new content is concerned, Drama production will continue to grow as will the focus on Originals. For global streamers in particular this is key to their consumer proposition as is the investment in local market productions.

Download the full survey results

Drama Production

Executives are more confident than they were at this point last year that drama production levels will continue to grow.

Original content remains a focus for the industry and a way for SVOD and broadcasters to better position themselves against competitors with their consumer proposition.

The increased content spend places more impetus on the success of distribution activity in markets where they have no outlets of their own.

Download the full survey results

Content Licensing

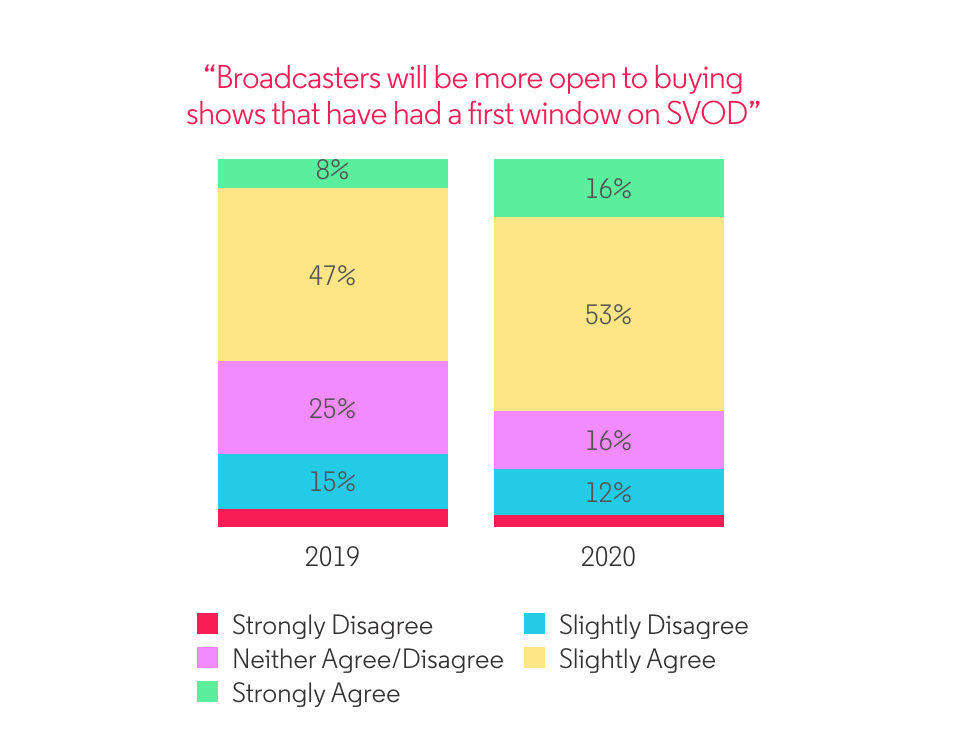

Industry executives believe broadcasters are now even more likely to take a post-SVOD second window. With more shows now coming back to the market we are finding numerous instances of scripted shows finding a second home on both Pay and Free TV channels.

In most instances the catch-up offer is minimal, with basic rolling 5 episodes at most. This poses a challenge when first window VOD rights remain and viewers can seek out the original home should they choose to binge view all episodes, rather than wait patiently for the linear broadcast.

Download the full survey results

Market Potential

Executives are slightly less optimistic about Asia’s growth potential than last year, but it still remains the number one international market for 42% of respondents.

Download the full survey results

Pay TV Initiatives

SVOD integration remains the key feature for Pay TV operators in 2020, followed by increased accessibility through TV everywhere and Home Gateway/Multi-Screen.

Enabling customers to access SVOD services through Pay TV platforms is an acceptance of the increased competition, but keeps the customer within the Pay TV ecosystem.

Whilst nPVR holds interest and 4K is growing, there is little change in other areas.

Download the full survey results

The 3Vision annual Trends Survey collates feedback from senior media executives.

Respondents are from global markets, and are asked to share their views on key areas.

Respondents include content owners, Pay TV platforms, distributors, and tech vendors.

Topics included major industry areas such as content licensing, drama production, pay TV initiatives and direct to consumer services.

Download the full survey results

.png)

.svg)