Samsung TV Plus recently launched its latest owned and operated (O&O) FAST channel, Samsung Television Network, in a move that underscores the increasing influence of Connected TV (CTV) manufacturers in the media landscape, particularly in the FAST space. Initially intended for the US, the channel is set to become the home of Samsung’s live TV content. This marks an interesting step in Samsung’s ever-growing influence in linear, especially in a market where trends show traditional Studio networks either losing money or closing down.

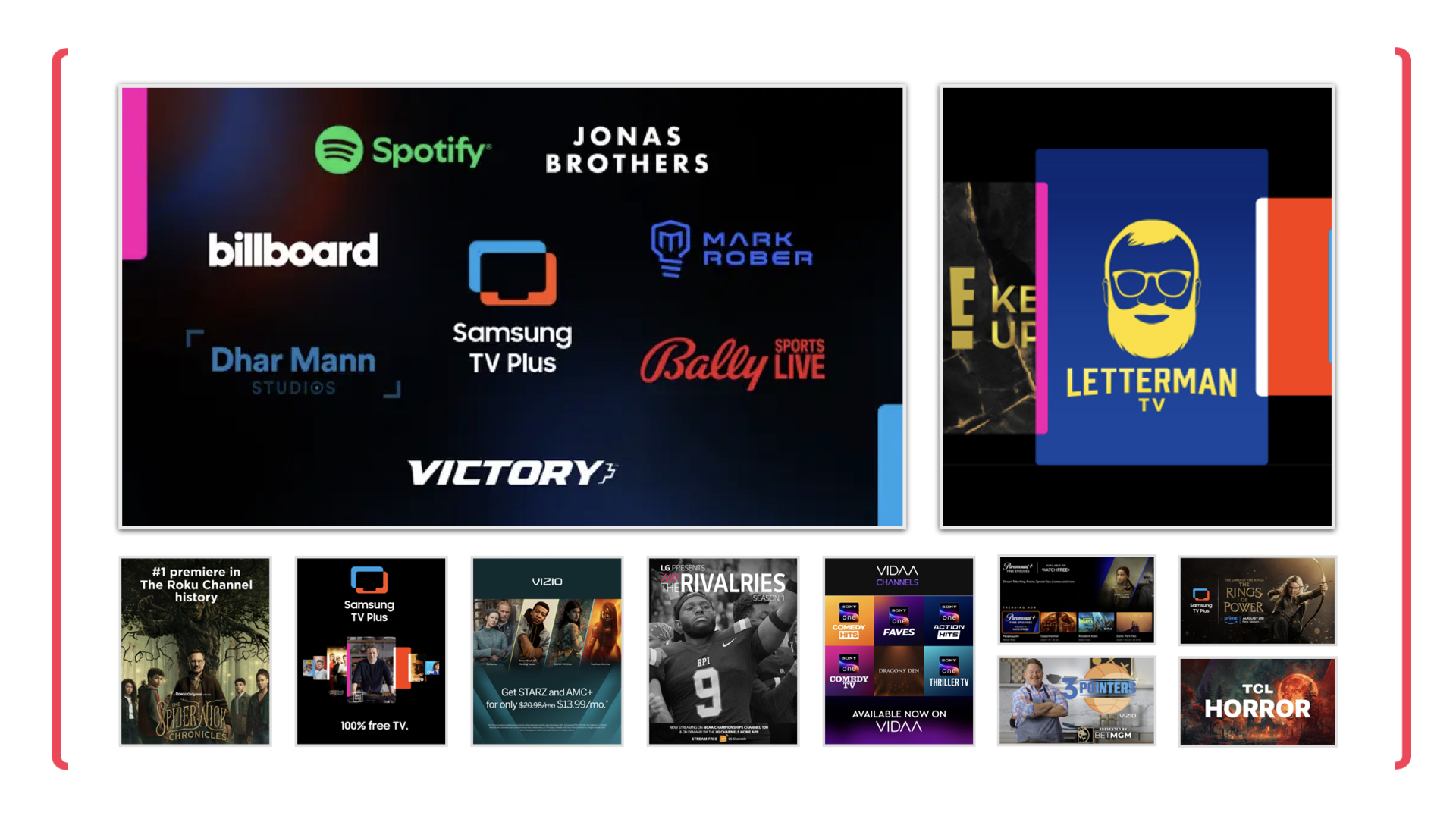

For much of its existence, FAST has been perceived as a means of monetising undervalued library content. However, in recent years, the market has undergone a shift, with more premium content now becoming a viable option. Samsung Television Network not only aims to emulate traditional networks in its name but also in the quality of its content. Beyond live events, the channels will feature popular talk shows hosted by renowned figures such as Conan O’Brien and David Letterman, as well as exclusive scripted content like “Killing Eve.” Moreover, the channel will showcase content from well-known YouTube and social media content creators, bringing a new creator-led perspective to the channel and further blurring the boundaries between YouTube and FAST.

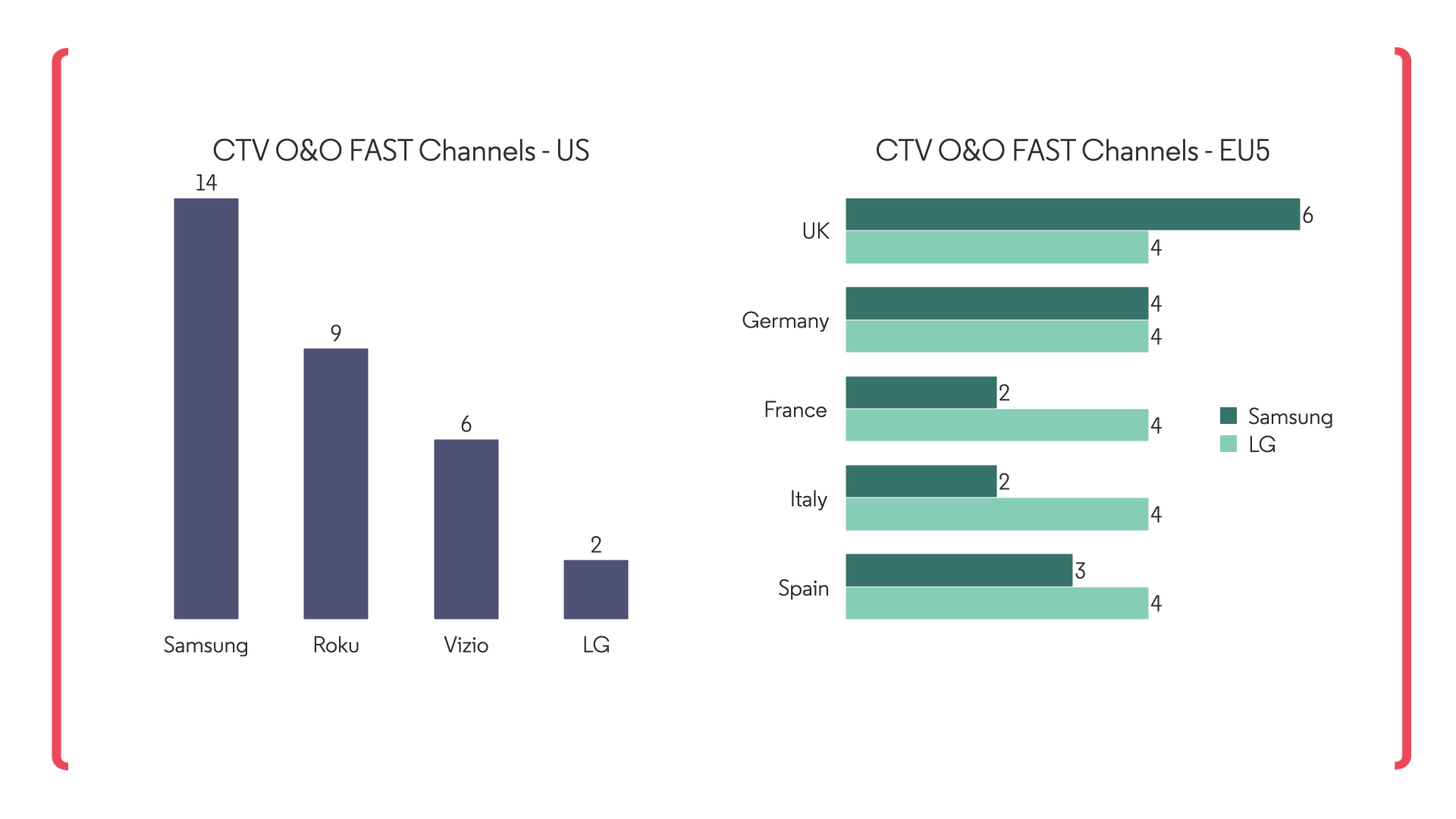

Samsung isn’t the only CTV platforms expanding its O&O offerings. Other major providers like LG, Vizio, and Roku are also investing in their FAST platforms and first-party content. LG recently expanded its O&O portfolio across Europe with its LG1 branded channels. Roku, which operates in the US and Canada, offers a range of Roku-branded channels and acquired IP, including This Old House, Emeril Lagasse, Martha Stewart, and Rich Eisen, which have all been transformed into their own single IP channels. While currently limited to the US market, Vizio also boasts a portfolio of branded channels, including multiple scripted and unscripted entertainment channels.

CTV players like Samsung, Roku, and Vizio are increasingly focused on platform revenues such as digital advertising, as the hardware margins for televisions have fallen. While many trends have shown a shift to smaller screens, especially amongst Gen Z audiences, the larger screen viewing market is still extremely healthy. By controlling the user interface (UI), new opportunities are arising both from a content distribution and advertising point of view. Shoppable ads are a new phenomenon and other ad format innovations will undoubtedly be driven by the CTV platforms and improve monetisation in the FAST and AVOD space. On the content front, it is clear to see the growing influence of the CTV platforms as they have a lot of control over what users see on their TVs. However, it remains to be seen how much investment they are willing to put into acquiring more premium content.

.svg)