Netflix’s position as Europe’s leading streaming platform is shifting from a story of scale to one of revenue diversification. Amassing 73 million subscribers by 2030, Netflix’s top 5 European markets are undergoing a huge shift in the balance between subscription and advertising income.

United Kingdom — From Saturation to Monetisation

The UK remains Netflix’s largest European territory by both subscribers and total revenue in 2025, set to generate $2.3 billion by 2030 - 10% of which will be ad-based. Yet its growth trajectory has shifted from expansion to optimization, supported by partnerships with Sky Media and local advertisers that have strengthened CTV ad demand. Following the withdrawal of the Basic plan and the continued rollout of the Standard with Ads tier, ad-supported subscribers will account for 30% of the UK base by 2030.

Germany - Europe’s Hybrid Powerhouse

By 2030, Germany will have overtaken the UK and France to become Netflix’s largest hybrid subscription market, with nearly 41% of its projected 7.3 million subscribers coming from the hybrid tiers. Strong bundling deals with MagentaTV, Vodafone GigaTV, and Sky Q have widened reach and reduced churn.

Advertising is also accelerating: by 2030 Germany overtakes France to become Netflix’s second-largest advertising market, reflecting high adoption of the ad tier and growing demand from local brands. The platform will generate $181 million in local advertising revenue by 2030 - 8% of total revenues. As Joyn and RTL+ expand their own hybrid models, Germany is now the benchmark for multi-tier streaming monetisation in continental Europe.

France - Balancing Regulation and Revenue

France continues to rank among Netflix’s top three markets, driven by a robust local production slate (Lupin, Tapie, Fiasco). While regulatory obligations such as investment quotas and content levies weigh on margins, Netflix’s local-first approach has solidified its cultural relevance, while the ad-tier rollout benefited from limited local CTV inventory and a partnership with TF1 Publicité. By 2030, France remains the third-largest total revenue market at over $2 billion, with hybrid and ad revenues growing faster than pure subscriptions.

Italy - Emerging Ad Growth Market

In 2025, Italy sits fourth in both AVOD and total revenue, generating around $1.1 billion - 4% of which is advertising-based. Although historically slower in subscriber growth, original productions such as Suburra and Nuova Scena continue to drive engagement, while an expanding smart TV base via TIMVision and OEM partners are shoring up its footprint across the country.

Spain - Holding Ground Through Hybrid Models

Spain rounds out Netflix’s top five markets in both total and hybrid subscription revenue. Supported by partnerships with Movistar+ and local CTV platforms, Netflix’s hybrid model has proved highly effective - accounting for 41% of 3.9 million subscribers by 2030. Despite competitive pressure from Atresplayer and Mitele Plus, Netflix retains strong brand loyalty.

Outlook - Europe’s Evolving Mix

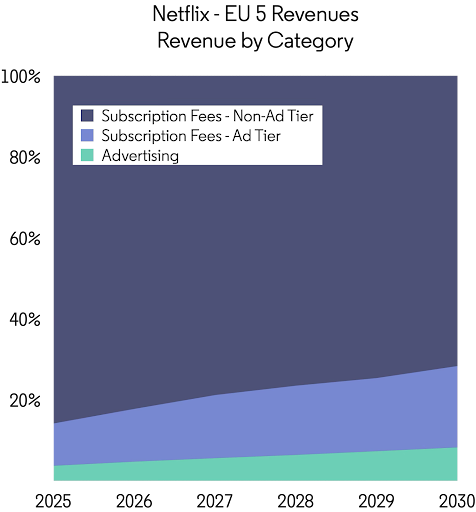

Between 2025 and 2030, Netflix’s European top five remain stable but reordered.Collectively, the top five grow to nearly $9.1 billion in total revenues by 2030 - 20% of which will come from Hybrid subscription fees, while 8% will come from advertising revenues. The UK continues to dominate total and ad revenues, but Germany and France are fast catching up through hybrid monetisation. While the top five stays consistent when ranked by total subscribers or total revenue, the Netherlands does creep into view when ranking by advertising revenues or hybrid subscription revenues, usually booting out Italy or Spain.

Across Europe, Netflix’s next growth phase will hinge less on pure subscriber gains and more on local ad-market integration and strategic bundling, marking a decisive shift from volume to value.

Netflix’s original content focus has seen significant growth in international markets. Show Tracker data shows that across all languages Netflix have been launching close to 140 New Season shows each season for the last four years (with returning shows on top of that number). The EU5 consistently represent over 20% of that volume, and whilst there is value in markets outside the originating market the primary return will be through supporting each local market. With these markets important to Netflix’s overall growth it will be interesting to follow their ongoing commissioning activity.

.png)

.svg)